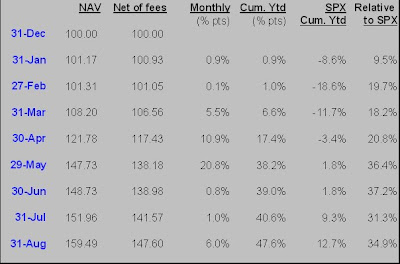

August was a better month for us, as certain positions (COT, DEI, EMMS) performed well. You can tell by our performance that we've been "struggling" the last few months to outpace the S&P; July was especially disappointing as we were up 1% compared to up 7.5% for the S&P. of course we understand that you can't beat the S&P every month, and we thought it was appropriate in July to take some gas off the pedal which is why the S&P gained on us. Still, we are happy with our ytd performance against the S&P but also mindful that we have to work harder than before to find ideas that will generate strong returns.

We decided to reduce exposure in two of the names that have worked very well this year, Cott and Douglas Emmett. With Cott, we feel that the market has come to appreciate the rebuilding story and the stock is no longer as cheap as it once was (remember we first bought in the $0.60 range). At the time we sold, the company was trading closer to book value and perhaps a 10x or high single digit PE multiple, compared to bottlers at 14x. While we think this gap should probably still narrow, we thought it was prudent to ease up and see how a summer cola price war shakes out. Plus, we are not entirely convinced that the shift to private label soda is here to stay. People like Coke and Pepsi. They don't want to drink Sam's soda the rest of their lives.

With DEI, we continue to believe the co has trophy properties, especially in the LA office sector. However, the stock reached a price point we had set in our head and while it seems like an interesting story, there is no shame in unloading the stock at $12 (we had bought in the $6 range).