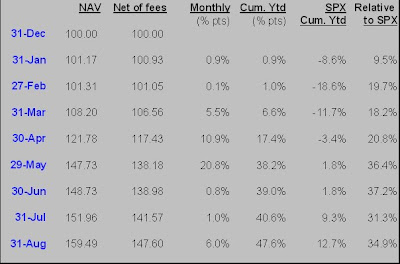

Sorry for the delay in posting Sep and Oct results. September was a fine month, up 3%, basically in line with the market. Some standouts were EMMS, UNH and PLA. We also added WLP during September, following the same basic theme as our UNH investment.

October was a relatively good month, up 1% compared to the -2% for the S&P. COT, MSFT and EMMS were the biggest positive contributor.

One name I want to discuss in this post is PLA. Admittedly I am late to describing the thesis since we added it to the book at a price of $2.50 on August 10th. However today the stock had a big move on rumors of a takeover bid so I think it is worth reviewing the original thesis below.

Over the years, we've followed a variety of media names, by which we mean cable, radio and content. The radio names are typically of interest because they generally have low capex and good free cash flow. The problem with radio is that private equity has already levered all the radio balance sheets so the fcf goes to pay down debt. This is why our thesis on EMMS isn't that the company is a great business (because we hate the leverage), but rather that it has interesting assets.

On the cable side, those companies also have great free cash flow, less crippling leverage than radio and are probably just fine businesses.

Content is something I've found intriguing since i became a fan of a French TV show called Star Academy. Note: here is a brief rant on how awesome Star Academy is. I saw just one episode (while on our honeymoon in French Polynesia) and thought it made American Idol seem like small potatoes. Basically, the show is a singing contest (like Idol), with a reality show component (like Big Brother), and the singers get to sing songs with famous people. PS-you can tell I like karaoke. PPS-here are some clips to show you what I mean:

Julio Iglesias

John Legend!

Anyways, the company that produces Star Academy, Big Brother and other reality-like shows is called Endemol. They got taken private at 15x+ ebitda in 2007.

So getting to the point at long last. Today, radio co's trade around 7x ev/ebitda, cable around 6-8x, and content (by and large) still 10+ turns. Why? Perhaps because it is an asset-lite model and the aura that good content is unique and hard to imitate. I set out on a mission to find "cheap" content. My two finalists were tickers NOOF (you can look it up) and PLA (Playboy). I chose to buy PLA (although I think NOOF is still interesting) because PLA was trading by my estimate, at <4x ev/ebitda and an attractive fcf yield. On top of this, you had asset support from: the Playboy mansion, the Playboy library and the Playboy brand (including licensing deals, etc). I was willing to make a bet on content, especially at an attractive multiple. I considered that PLA is a magazine publisher too (and magazines are having a tough time these days) but that didn't dissuade me. Hugh Hefner, the founder of PLA, continues to own a controlling stake and may be finally a willing seller. His daughter Christie, who until recently served as CEO, was replaced and a turnaround effort is in place as well. So that (ie, low valuation, iconic brand, willing seller, and if nothing else a turnaround story) is my basic, oversimplified thesis on PLA.